How Surgeons Can Build Wealth with Passive Real Estate Investments

You’re Earning High Income But Are You Building Real Wealth?

As surgeons, we are trained to manage crises, solve complex problems, and make life-saving decisions under pressure. Yet when it comes to financial independence, many of us still rely heavily on a single income source: our active medical practice. That approach leaves us vulnerable to career burnout and a lack of long-term wealth preservation.

I started thinking about my own financial future. It’s what pushed me to explore passive real estate investments as a way to build wealth without adding more to my already demanding schedule.

As Nobel laureate Harry Markowitz famously said, “Diversification is the only free lunch in investing.” Diversification isn’t just a buzzword, it’s a proven strategy to mitigate risk and maximize long-term returns. Passive real estate investments are one of the best ways to achieve this, offering stability, tax advantages, and wealth preservation while letting you focus on your career and personal life.

How can you diversify your income streams, preserve your wealth, and take actionable steps toward financial freedom through passive real estate investing? Let’s dive in.

Why Surgeons Should Consider Passive Real Estate Investments

Your Most Valuable Asset: Time

As a surgeon, your time is your most limited and precious resource. While traditional investments in stocks, bonds, or even active real estate can require ongoing attention, passive real estate investments are designed to generate income without demanding your daily involvement.

By partnering with an experienced partner, you can focus on what you do best, caring for patients and spending quality time with family, while your investments quietly work for you in the background.

Key Benefits of Passive Real Estate Investing for Surgeons

Predictable Income, Stability, and Tangible Value

The stock market can be a rollercoaster. One day you’re up, the next you’re down. Real estate, on the other hand, offers more stable returns.

Here’s why:

- Multifamily properties provide consistent rental income due to the steady demand for housing.

- Medical office buildings are particularly resilient, given the constant need for healthcare services.

- Retail properties with long-term tenants offer reliable cash flow over time, thanks to established leases with stable businesses.

In addition to predictable cash flow, real estate is a tangible asset. You can see it, evaluate it, and even walk through it. Unlike stocks or bonds, which exist as numbers on a screen, real estate has inherent value tied to the land and the structures built on it. Even in times of economic uncertainty, tangible assets like real estate tend to hold their value better than paper investments.

Tax Advantages

One of the often-overlooked benefits of real estate is the favorable tax treatment.

Unlike stocks, real estate investments allow for:

- Depreciation deductions: Offset taxable income with the natural wear and tear of property.

- 1031 exchanges: Defer capital gains taxes by reinvesting in new properties.

- Interest expense deductions: Reduce taxable income by deducting mortgage interest.

These advantages mean that real estate can help you reduce your overall tax burden, increasing your after-tax returns.

With the current administration fostering a more favorable real estate climate, these benefits are likely to remain intact or even expand. Policies supporting real estate development and investment mean that this could be an especially opportune time to enter or increase your presence in the market.

These tax advantages translate to more money in your pocket, boosting your after-tax returns and helping you accelerate your path toward long-term financial independence.

Diversification & Risk Mitigation

Relying solely on one asset class, like stocks or even real estate, exposes you to greater risk. While stocks have performed well, history has shown that the stock market returns average ~9-10% over time. This suggests that the 20% returns over the past two years will be balanced out by returns lower than the average. We’ve seen significant downturns in the past, and it’s only a matter of time before the next correction occurs. Without diversification, a stock market downturn could severely impact your wealth and long-term financial goals.

By diversifying into passive real estate investments, you add an asset that operates independently from the stock market. Real estate follows its own drivers, for example, local demand, property-specific factors, and interest rates, making it less correlated with traditional investments. This means that even when the stock market fluctuates, well-selected real estate investments can continue generating steady income and appreciating over time.

Here’s a simplified way to think about diversification using the correlation coefficient:

- Correlation measures how investments move in relation to one another, on a scale from -1 to +1.

- A +1 correlation means investments move in the same direction. A -1 correlation means they move in opposite directions.

Stocks and real estate typically have a low correlation, meaning they respond to different economic factors. Adding real estate to your portfolio spreads your risk and reduces the impact of a downturn in any single asset class.

Long-Term Appreciation

In real estate, appreciation refers to the increase in a property’s value over time. This can happen for several reasons, including rising demand in a specific area, improvements to the property, and broader economic growth. Unlike many other investments, real estate can not only generate steady cash flow but also tends to gain value over the long term—especially in high-demand markets.

For surgeons like you, appreciation provides a powerful wealth-building advantage. While the passive income from rent helps to cover expenses and grow your cash reserves today, the long-term increase in property value boosts your overall net worth.

Appreciation provides a dual benefit:

- Passive income today: Rental payments cover expenses and generate cash flow.

- Wealth-building tomorrow: Over time, the property’s value grows, increasing your net worth.

Leverage Other Experts’ Knowledge

One of the biggest advantages of passive real estate investing is that it doesn’t require you to become an expert in real estate.

You don’t need to spend countless hours searching for deals, negotiating with sellers, managing properties, or dealing with tenant issues. Instead, you can partner with experienced professionals who handle all the heavy lifting allowing you to benefit from real estate’s income and growth potential without adding another job to your already busy schedule.

A Step-by-Step Guide for Surgeons to Get Started

STEP 1: Build Your Knowledge

When I was first considering real estate investments, I knew I needed to get educated. The idea of putting my hard-earned money into something I didn’t fully understand was daunting, and I’m guessing you feel the same way. That’s why the first step is to build your knowledge base.

Start by reading books on passive real estate investing, attending webinars, and joining communities of like-minded professionals. You don’t need to become an expert in every aspect of real estate, you just need to learn enough to ask the right questions and understand the fundamentals.

At Apta Investment Group, we’ve designed educational resources specifically for physicians. We help you get up to speed quickly so you can make informed decisions without feeling overwhelmed.

Build Your Knowledge: Action Tip

- Set aside 1 hour a week to read a book, listen to a podcast, or watch a webinar about passive real estate investing. Over time, that steady learning compounds, and you’ll feel more confident evaluating opportunities.

STEP 2: Allocate Savings Wisely

As a high-income professional, you may already be saving diligently. But are you allocating those savings in a way that sets you up for long-term financial freedom?

A general rule of thumb is to save at least 20% of your income for investments. Within that, aim to allocate a portion to passive real estate. This strategy ensures you’re building wealth in assets that provide both cash flow and appreciation over time.

When I started investing, I made the mistake of putting nearly all my savings into the stock market. After a few volatile years and sleepless nights, I realized I needed a more balanced approach. Diversifying into real estate gave me steady, predictable income, which helped offset the wild swings in my stock portfolio.

Allocate Savings Wisely: Action Tip

- Automate your savings. Set up automatic transfers to an investment account each month. This removes the friction of decision-making and ensures you consistently fund your long-term goals.

STEP 3: Establish an Emergency Fund

You’ve probably had a moment in your career when life threw something unexpected your way. Whether it was a personal emergency or a sudden expense, having an emergency fund of 6-12 months of living expenses ensures that you can handle life’s surprises without disrupting your long-term investment plans.

One surgeon I know was ready to invest in real estate, but right before committing, his family faced an unexpected medical expense. Thankfully, he had built up a solid emergency fund, which allowed him to take care of the situation without touching his long-term investments. Once things stabilized, he felt more comfortable moving forward with his investment strategy.

Establish an emergency fund: Action Tip

- Keep your emergency fund in liquid, low-risk accounts like high-yield savings or money market accounts. While it may not earn high returns, its primary purpose is to provide immediate access to cash when you need it most.

STEP 4: Diversify Your Portfolio

Many physicians rely heavily on stock portfolios and retirement accounts, but that approach leaves you exposed to market volatility. By diversifying into real estate and other alternative assets, you reduce your overall risk and increase the stability of your returns.

Imagine this, during a stock market downturn, your multifamily property investments continue generating steady rental income, helping you maintain cash flow while your equity investments recover. That’s the power of diversification.

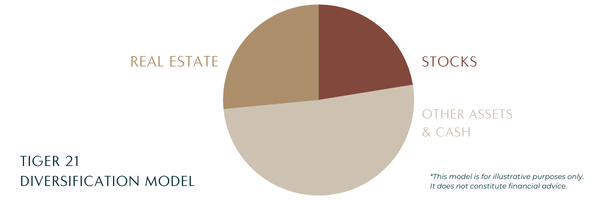

Consider the approach taken by Tiger 21, a group of high-net-worth investors with average investable assets of over $20 million. Their diversification model includes:

- 22% in stocks for liquidity and growth potential.

- 26% in real estate for income, appreciation, and stability.

- The remaining allocation is divided among private equity, bonds, cash, and other assets.

This model highlights the importance of real estate as a foundational piece of a balanced portfolio. Even if you’re not yet managing an eight-figure portfolio, you can still learn from their intentional diversification strategy to build wealth over time.

Diversify Your Portfolio: Action Tip

- Start by diversifying into one passive real estate deal. Over time, you can add more properties to build a robust portfolio.

STEP 5: Reallocate Based on Your Timeline

Your investment strategy should evolve as you move through different stages of your career. Early in your career, you may prioritize more liquid assets for flexibility, but as you approach retirement, shifting more into stable, long-term real estate investments can help preserve your wealth and provide passive income.

Here’s a simple breakdown:

- 0-5 Years: Focus on low-volatility, liquid investments like cash and bonds. These assets provide easy access to funds and protect against short-term market fluctuations.

- 5-10 Years: Introduce medium-risk assets like index funds. These offer growth potential without extreme volatility.

- 10+ Years: Allocate more toward real estate and other long-term investments. These assets generate passive income and can appreciate significantly over time.

Reallocate Based On Your Timeline: Action Tip

- Review your portfolio annually and adjust your allocations as needed. If your goals or financial situation changes, you’ll want your investment strategy to reflect that.

Why Partner with Apta Investment Group?

At Apta, we specialize in helping surgeons like you take control of their financial future through passive real estate investments. We know your time is limited, so we focus on doing the heavy lifting while you enjoy the benefits.

Our S.A.F.E.R. System (Skill Development, Asset Allocation, Fund Emergency Needs, Embrace Diversification, Reallocate by Timeline) is designed to guide you through each stage of your investment journey, ensuring that you make confident, informed decisions.

Take Action Towards Financial Independence

Passive real estate investing offers a way to diversify your income, preserve wealth, and gain financial freedom without adding more to your already packed schedule. By leveraging this strategy, you can focus on what matters most: your patients, your family, and your passions.

When you’re ready to explore your options, Apta Investment Group is here to help. Our commitment is simple: If it’s not the right fit, we won’t recommend you invest. Your best interest is always our top priority.

Join Our Investor Network to take your first step toward financial independence.

*Apta Investment Group does not provide financial, legal, or tax advice. We recommend consulting with qualified advisors before making any investment decisions.