I was reviewing a property package for a new medical office acquisition when a headline lit up my phone:

“One Big Beautiful Bill Passes: Major Tax Reform Signed Into Law.”

Within minutes, my inbox filled up. Colleagues had questions. Investors were curious. Everyone wanted to know: What does this mean for us?

It’s a fair question. For years, many of us followed the standard formula: work hard, save diligently, invest in the stock market, and hope compounding does its job. But for high-income professionals, especially physicians, that strategy often leaves us overworked, overtaxed, and financially exposed.

That was true for me, until I shifted my investment strategy to focus on passive income through real estate. But things accelerated when I learned how to align investments with tax policy. That’s when I stopped reacting and started building long-term financial confidence and control.

And now, with the passing of the One Big Beautiful Bill (OBBB), we’re seeing one of the clearest roadmaps in recent memory for how high-income professionals can build durable wealth without being chained to a scalpel or screen.

Let’s break down what matters.

A Wake-Up Call for High Earners

On paper, many physicians look successful. Strong income. Retirement accounts. Market exposure. But beneath the surface? You’re still trading time for money, still navigating tax drag, and still tied to volatile public markets.

The common challenge is overexposure to active income and under-leverage of tax-efficient strategies.

OBBB is a pivot point. It’s a chance to rethink how we grow and preserve wealth, not by working harder, but by investing smarter and more intentionally.

What OBBB Offers to Passive Real Estate Investors

This bill isn’t just a collection of tax updates. It’s a strategic shift that favors those investing through well-structured, tax-efficient vehicles, especially in private real estate. Here are the most investor-relevant provisions and why they matter.

1. 100% Bonus Depreciation is Back

One of the most significant changes is the return of 100% bonus depreciation, now made permanent.

In practical terms, this allows investors in real estate to accelerate depreciation deductions, shielding much of their passive income from taxes, especially in the first year. For example, if you invest in a multifamily project that undergoes a cost segregation study, a method that breaks down the property into parts (like appliances, flooring, and lighting) so they can be depreciated faster for tax purposes.

You may be able to deduct a substantial percentage of your initial investment in year one.

That means tax savings today, while your investment continues to generate income and grow in value.

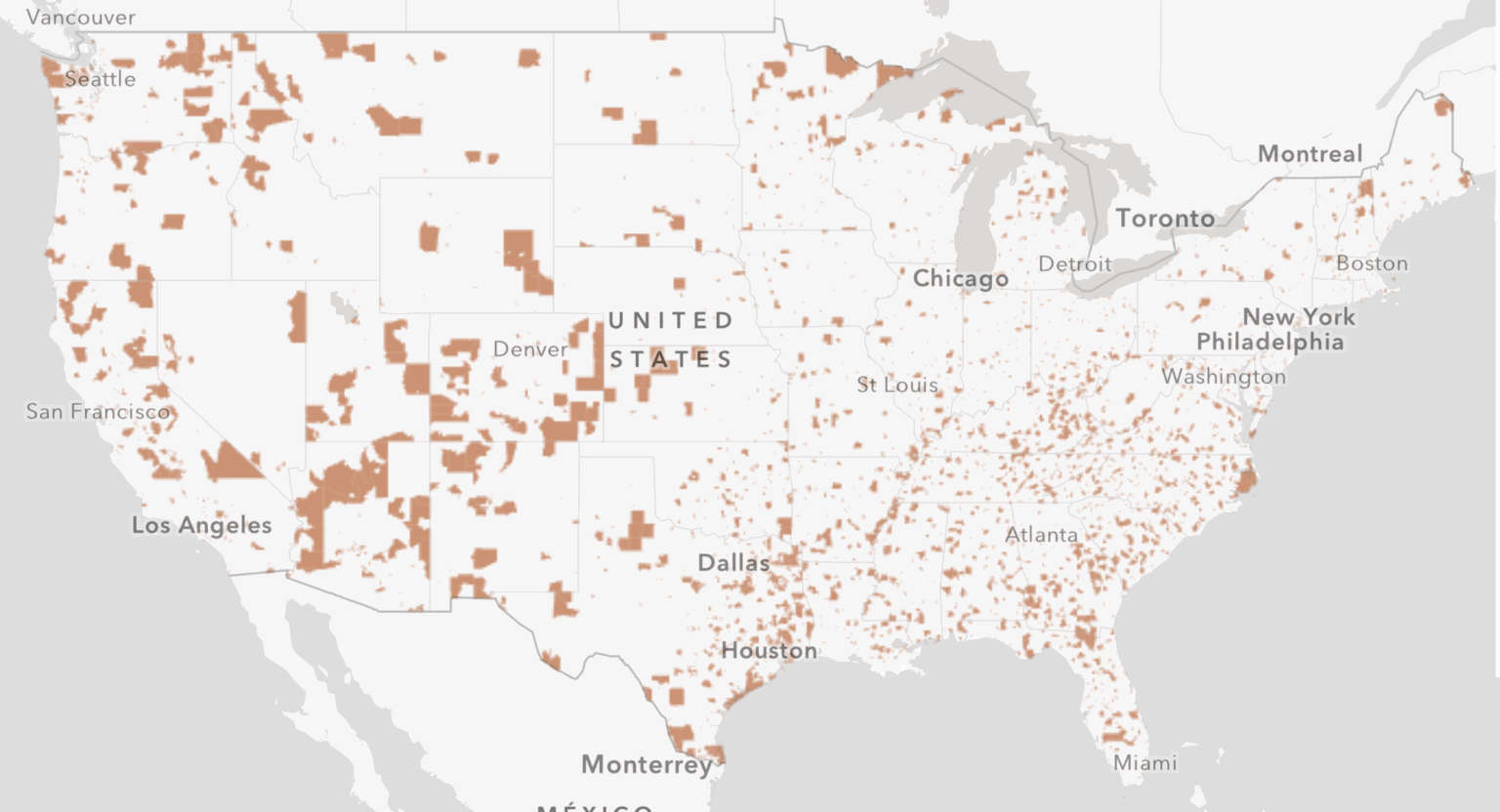

2. Opportunity Zones 2.0: Now Permanent

The original Opportunity Zones program was powerful. The new version is even more attractive.

If you roll capital gains into an Opportunity Zone (OZ) investment, whether from a business sale, stock liquidation, or real estate exit, you can defer taxes on those gains. And if you hold the new investment for 10 years, the appreciation becomes fully tax-exempt.

OBBB makes this strategy permanent and introduces new incentives for rural zones. That’s a big win for investors focused on tax efficiency and long-term growth.

3. Expanded Section 179 Deductions: More Write-Offs Upfront

If you invest in projects with capital expenditures, like medical offices, retail centers, or value-add multifamily, Section 179 now allows you to deduct a larger portion of those investments in year one.

This allows investors to take dollars that would’ve gone to the IRS and put them to work in assets that generate income, appreciate over time, and contribute to your long-term wealth building through real estate.

4. 20% Pass-Through Deduction (Section 199A)

This deduction allows qualified pass-through entities (like LLCs and partnerships) to reduce their taxable income by 20%. For investors in private real estate, this means you can keep more of your passive earnings, especially when combined with depreciation and interest deductions.

It’s a quiet but powerful provision that boosts the after-tax return of real estate investments held in the right structure.

5. Estate Tax Exemption Increased to $15M

Starting in 2026, the lifetime estate and gift tax exemption will increase to $15 million per individual ($30 million for couples).

This gives high-income professionals much more room to plan their legacy. You can now transfer passive real estate holdings to heirs or trusts with significantly lower estate tax exposure, making real estate a powerful tool for long-term generational wealth.

6. state and local tax (SALT) Deduction Cap Raised to $40,000

The new bill raises the cap on state and local tax (SALT) deductions from $10,000 to $40,000, phasing out at a $500,000 income threshold.

For those living in high-tax states, like California, New York, or New Jersey, this change allows for more after-tax income. When combined with pass-through entity strategies that shift state tax burden to the entity level, this can unlock even more federal tax deductions.

What It All Means for Passive Investors

If you’ve ever felt uncertain about whether real estate is a good fit, now is the time to revisit that belief. This isn’t about becoming a landlord. It’s about leveraging well-structured, professionally managed passive real estate investments to create:

- Steady income without daily effort

- Significant tax advantages

- Reduced reliance on clinical hours

- A path to financial freedom that’s not tied to market swings

And none of this requires you to learn how to underwrite deals or manage tenants. That’s the beauty of passive investing done right. The OBBB didn’t just tweak a few line items. It restructured the playing field for anyone serious about building wealth through alternative investments, especially real estate.

What a Real Investment Strategy Looks Like Under OBBB

Let’s run a simple, real-world example:

You and a group of investors commit $10 million into a $30 million multifamily project in a strong growth market. The project undergoes a cost segregation study and uses 100% bonus depreciation, generating significant paper losses in year one.

Those losses can offset other passive income, lowering your overall tax bill.

By year 5, the property stabilizes and undergoes a cash-out refinance, returning a large portion of your capital.

By year 10, the property sells for $40 million. Using a 1031 exchange, you defer all taxes on the gain and reinvest the full proceeds into another asset.

You now own a larger asset, earning passive income on a higher basis with no capital gains taxes due.

Here’s why that matters:

You can compound your portfolio with money that you would have otherwise paid in taxes, a higher base from which you can grow. In this example, the $30 million apartment that you sell in ten years for, say $40 million means your $10 million investment now becomes $20 million. Instead of paying taxes on that $10 million gain, you can invest that entire $20 million. So if you were receiving 5% annual income on the original $10 million, you’re now earning 5% on $20 million or 10% on your original capital.

This is how real estate lets you “cascade up,” turning one well-planned investment into a long-term wealth-building engine.

Still Skeptical? You’re Not Alone

Every time tax reform rolls out, I hear the same concerns:

“These incentives won’t last.”

Except many of them, like bonus depreciation and Opportunity Zones, are now permanent, a major shift from previous temporary provisions.

“This is for billionaires.”

No. These tools are designed to support private investors and business owners, especially If you’re a high-income professional building for the future especially through wealth building with real estate. These are alternative investments designed to give more control back to the investor, more tax efficiency, more predictable income, and more freedom.

“I don’t want to manage real estate.”

You don’t have to. Passive real estate investing puts your capital to work in institutional-quality projects, managed by experienced teams.

You stay focused on your calling. Your money keeps growing in the background.

The real risk is being indecisive

When I talk to physicians about their hesitation to invest in real estate, it’s rarely about the numbers. It’s about uncertainty. Fear of making a mistake. Worry that they missed the window.

But here’s the truth: The real risk isn’t trying something new; it’s staying stuck in strategies that no longer serve you.

You don’t need to become a tax expert. You don’t need to manage buildings. You just need the right team, the right structure, and the right strategy.

The physicians who take action, who step into well-structured alternative investments with the right partners, aren’t just diversifying their portfolios. They’re buying back their time. They’re building resilience into their finances and their future.

At Apta, we co-invest in every deal we offer. We focus on cash flow, tax efficiency, and long-term value. Our investments are built for people who want to practice medicine by choice, not obligation.

If you’re ready to explore how these policy changes could fit into your own plan for wealth building through real estate, we’d love to have you join our investor network. You’ll gain access to curated opportunities, insights built specifically for physicians, and a community that invests with purpose.

*Apta Investment Group does not provide financial, legal, or tax advice. We recommend consulting with a qualified financial advisor before making any investment decisions.