Real estate investing isn’t about avoiding mistakes

It’s about learning, adapting, and taking control of your financial future.

We’ve all been there, staring at an opportunity, analyzing every angle, weighing the risks, trying to make the “perfect” decision. And in that process, what happens?

Time passes.

The deal moves on.

And you’re left exactly where you started.

This is analysis paralysis. It’s the silent killer of wealth-building opportunities, especially in real estate.

I get it. Real estate investing isn’t always smooth sailing. Maybe you’ve heard horror stories. Maybe you’ve even lost money on a deal before. But let me ask you this:

What did you learn from that experience?

Making mistakes doesn’t mean you failed. It means you have more knowledge than the person who never even tried.

And right now, more than ever, that experience could be the biggest advantage you have in front of a generational opportunity.

The Market Has Shifted in Your Favor

Over the past couple of years, rising interest rates and construction costs caused many investors to hit pause. But markets are cyclical and what felt uncertain yesterday is showing clarity today.

In fact, signs point to 2025 and beyond as an exceptional entry point for passive investors in multifamily.

Here’s why:

- Construction has slowed dramatically. High borrowing costs have pushed developers to the sidelines, creating a bottleneck in future apartment supply.

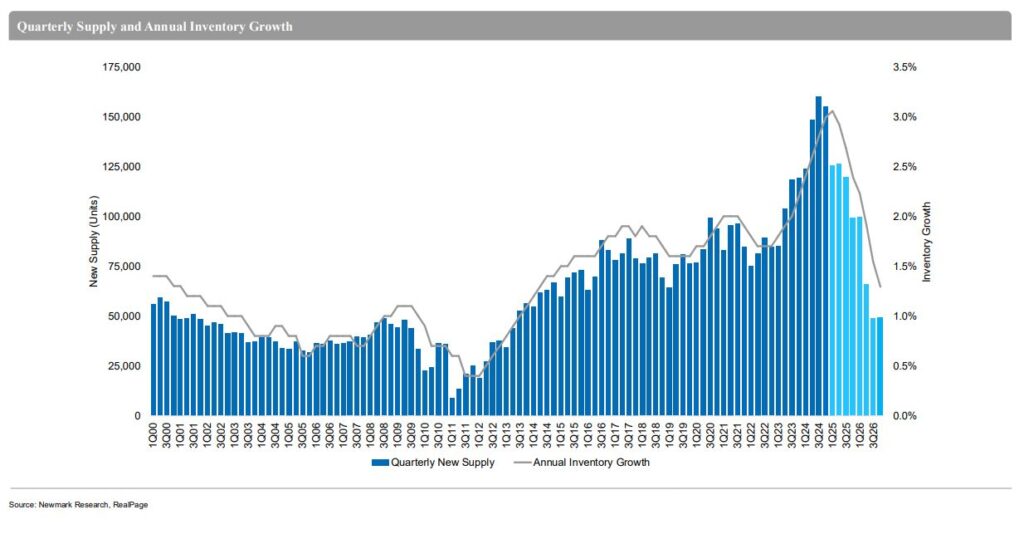

New Supply Begins to Decline – Pipeline to slow through 2025-2026

A total of 155,408 units were delivered in the fourth quarter of 2024, a 3.2% decline from the record high in 2Q24. New deliveries are expected to slow further, with a more pronounced deceleration anticipated in 2025 and 2026.

- Demand for rentals is only rising. Homeownership remains out of reach for many, and lifestyle trends favor flexibility keeping multifamily demand strong.

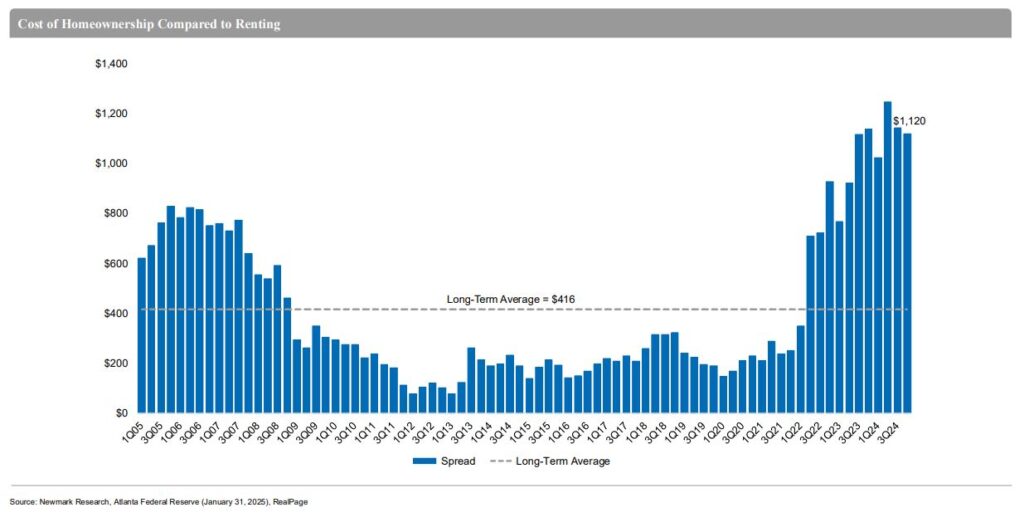

Renting is more cost-efficient than homeownership. – gap remains 2.7x Average.

The spread between the total median monthly payment for homeownership and the average effective rent for apartments reached $1,120 as of the fourth quarter of 2024, a 1.6% year-over-year decline. Despite this narrowing, the spread has remained above the long-term average of $416 for 11 consecutive quarters.

- Rent growth is accelerating. Experts predict 4–6% annual rent increases in high-growth markets well above the historical average of 3%.

The Hidden Upside

This is a key point often missed: Today’s real estate investments offer a significant upside.

When you combine rising rents with fixed-rate debt, it creates an asymmetric risk/reward scenario:

- Upside Potential: As rents increase, income rises while debt service stays the same.

- Downside Protection: Reduced supply and strong demand act as a floor under asset values.

In other words, you’re entering a market where cash flow is growing, risk is capped, and long-term appreciation is likely. That’s not speculation, that’s strategic positioning.

Even the public markets are catching on: multifamily REITs like MAA and CPT are up 40–46% over the last 16 months. Private real estate, typically a steadier, lagging indicator, often follows suit.

Murphy’s Law: When the Unexpected Happens

Inevitably, things will go wrong, even with meticulous planning. Remember Murphy’s Law, anything that can go wrong will go wrong.

We bought several multifamily properties when interest rates were low, using variable rates. To mitigate risk, we purchased a rate cap, meaning our interest rate couldn’t exceed a certain percentage. However, we didn’t anticipate the fastest rise in interest rates in the history of the Federal Reserve. Our rate cap covered us, but then our lender, Freddie Mac, required us to take cash from the property and put it into a rate cap escrow, funding 125% of the current cost of the rate cap.

This meant we couldn’t use the extra cash to make distributions, reducing our cash flow. Fortunately, we were only 50% leveraged, so we didn’t need to sell any properties when values were down.

Even though we thought we had taken everything into account, black swan events still happen. And they can impact everyone. But if you do your due diligence carefully, you won’t go belly up like those who didn’t plan so well.

The Power of Perspective and Action

When facing challenges, it’s easy to make excuses, point fingers, or avoid taking full responsibility. But what’s more productive is stepping back and assessing the situation for what it actually is – no exaggeration, no catastrophic thinking.

Your state of mind affects everything.

Most of our daily thoughts are negative, which makes it easy to take a tough situation and spiral into worst-case thinking. Instead, practice radical transparency with yourself. What limiting beliefs or negative thought patterns are holding you back?

Then, take an inventory of what was actually under your control. It’s useless to beat yourself up over things beyond your influence. Instead of jumping to conclusions that a setback is a failure, adjust your lens. Ask what can I learn and how is this beneficial to my outcome.

This is how you take control. Because the only two things under your control are:

- The lens you use to view the world.

- The actions you take in response.

Failure vs. Learning: The Choice Is Yours

I’ve spoken with countless surgeons, professionals, and investors who hesitate to take their first step into real estate because they’re afraid of making a mistake. And my response is always the same: you can’t fully learn if you’re not participating.

Think about it. Did you become an expert in your field by reading books and watching others work? No. You got your hands dirty. You stepped into the operating room. You practiced. You refined your skills. Investing is no different.

Every seasoned investor has faced setbacks. But the best ones use those setbacks as stepping stones. They refine their approach, adjust their strategy, and keep moving forward. That’s how real wealth is built.

*Apta Investment Group does not provide financial, legal, or tax advice. We recommend consulting with qualified advisors before making any investment decisions.

Your Skills Are the Ace Up Your Sleeve

In my soon-to-be-released book, The Surgical Investor, I talk about how your specialized skills are your competitive advantage in real estate investing. You already have a skill set that makes you uniquely positioned for success:

- Analytical Precision – You’re trained to assess complex situations and make precise decisions, whether in the OR or reviewing an investment deal.

- Creditworthiness – Lenders trust you. Banks want to give you money. That’s leverage most people don’t have.

- Leadership Skills – You’re used to making critical decisions and managing teams. That experience translates seamlessly into real estate.

- Problem-Solving Mindset – Every deal comes with challenges. Your ability to troubleshoot and adapt is a powerful advantage.

- Calm Under Pressure – When markets shift, or unexpected issues arise, you won’t panic like the average investor. You’ll navigate challenges with the same composure you bring to the operating room.

Building Your Understanding of Passive Real Estate Investing

If you’re looking to deepen your knowledge of passive real estate investing, you don’t have to figure it out alone.

I created the Apta Knowledge Hub as a go-to resource to help surgeons and other professionals get a clear, no-nonsense understanding of real estate investments. Inside, you’ll find educational content that breaks down the strategies, risks, and rewards of passive investing without the fluff.

And if you’re ready to take a deeper dive into the mindset and strategies behind financial independence, The Surgical Investor is my guide for physicians looking to build real wealth through real estate.

This book will walk you through:

- How to transition from a high-income job to financial freedom.

- How to leverage your skills to gain a competitive edge in real estate.

- How to avoid common investment pitfalls and build a sustainable portfolio.

Your knowledge and experience are your greatest assets so start investing in it today.

The Game Won’t Wait for You

If you’re waiting for the “perfect” moment, let me save you some time: It doesn’t exist.

The best investors aren’t those who never make mistakes. They’re the ones who keep playing, keep learning, and keep adjusting. The real estate market rewards action takers, not perfectionists.

If you’ve been sitting on the sidelines, wondering when the right time to invest is, the answer is now.

Not because the market is perfect. Not because there’s zero risk. But because experience is the best teacher, and the only way to truly gain that experience is to step in and start.

What’s Your Move?

If you’ve been hesitating to invest in real estate, ask yourself:

- Are you letting past mistakes (yours or someone else’s) keep you from moving forward?

- Are you expecting to master investing without actually participating?

- Are you willing to stay on the sidelines while others build wealth?

The only way to win the game is to play.

So, what’s your next move?

Start learning today with the Apta Knowledge Hub. If you’re ready to explore investment opportunities, let’s talk.

If you’ve been sitting on the sidelines, wondering when the right time to invest is, the answer is now.

Not because the market is perfect.

Not because there’s zero risk.

But because experience is the best teacher, and the only way to truly gain that experience is to step in and start.

Join Our Investor Network to take your first step toward financial independence.

*Apta Investment Group does not provide financial, legal, or tax advice. We recommend consulting with a qualified financial advisor before making any investment decisions.